Estate Planning

Estate Planning for Unmarried Partners: How to Get Started

June 30, 2022

How to Choose Fiduciaries for Your Estate Plan

June 9, 2022

What Types of Assets Should You Use to Fund a Revocable Trust?

May 26, 2022

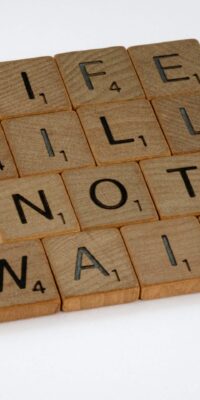

5 Tips to Stop Procrastinating and Start Estate Planning

May 12, 2022

6 Tips to Organize Finances Before Starting Estate Planning

April 28, 2022

Expecting the Unexpected: Estate Planning for a Catastrophic Injury

April 7, 2022

Expecting the Unexpected: Estate Planning for a Chronic Illness

March 24, 2022

Expecting the Unexpected: Estate Planning for a Catastrophic Illness

March 10, 2022

What Is an NFT and How Do You Transfer Ownership of NFTs at Death?

February 24, 2022

What Happens to Your Digital Presence After You Die?

February 17, 2022